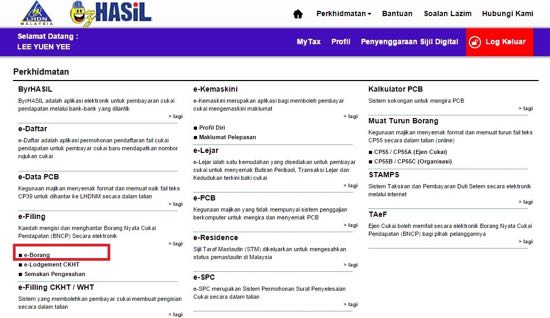

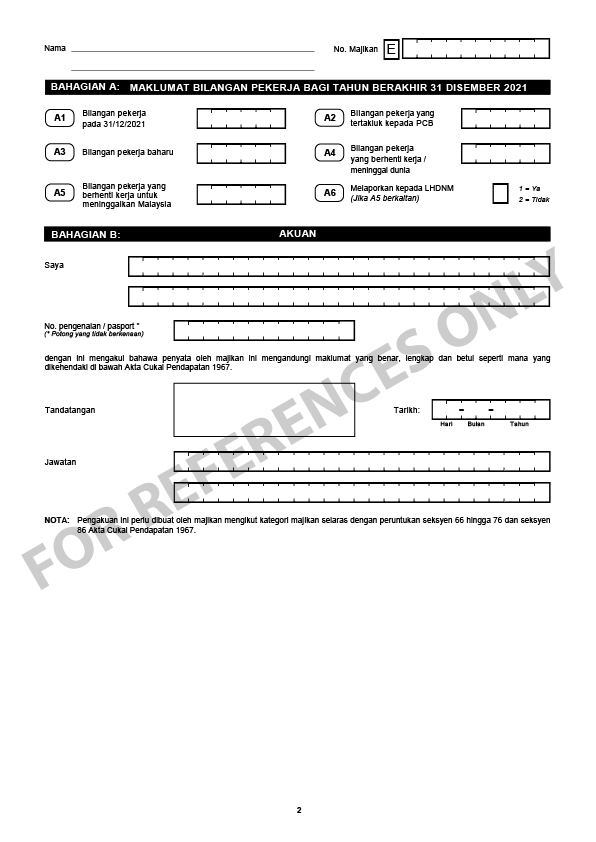

E 2020 Employer 31 March 2021 BE 2020 Resident Individual Who Does Not. Form e borang e is a form that an employer must complete and submit to the internal revenue board of malaysia ibrm or lembaga hasil dalam negeri lhdn.

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

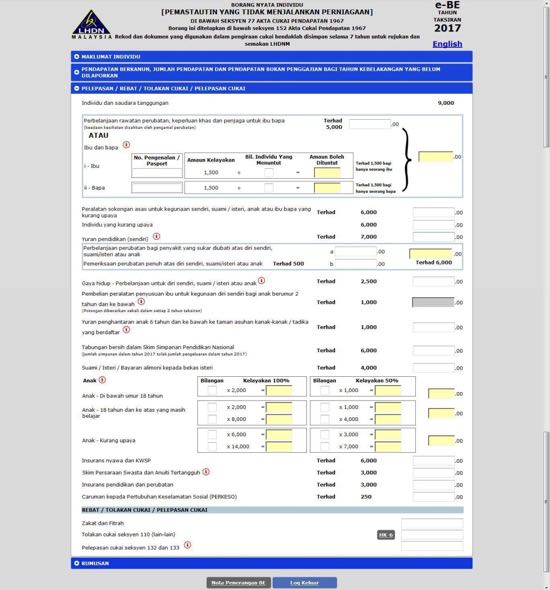

The due date for submission of Form BE for Year of Assessment 2020 is 30 April 2021.

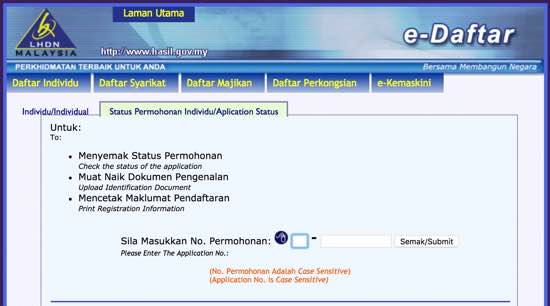

. 30 Jun 2021 31 Julai 2022. Fill in this form with the details required which include the date of your business the type of your. LHDN has released 2020 Borang E EA on 12 January 2021.

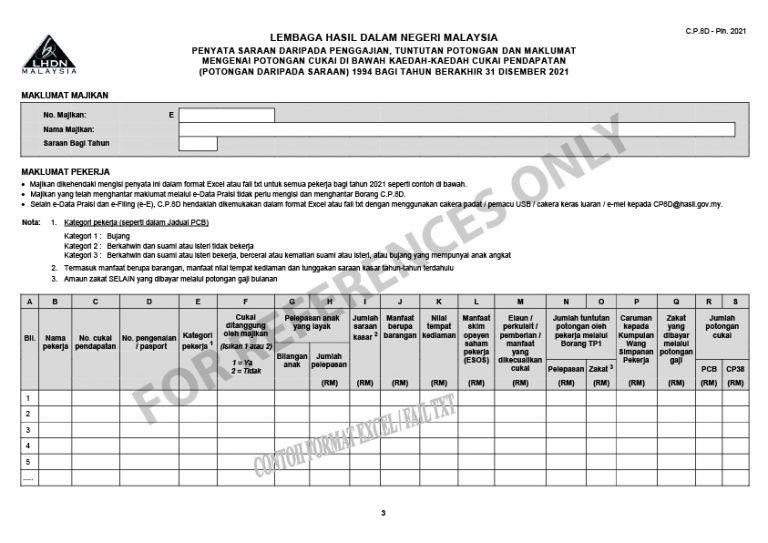

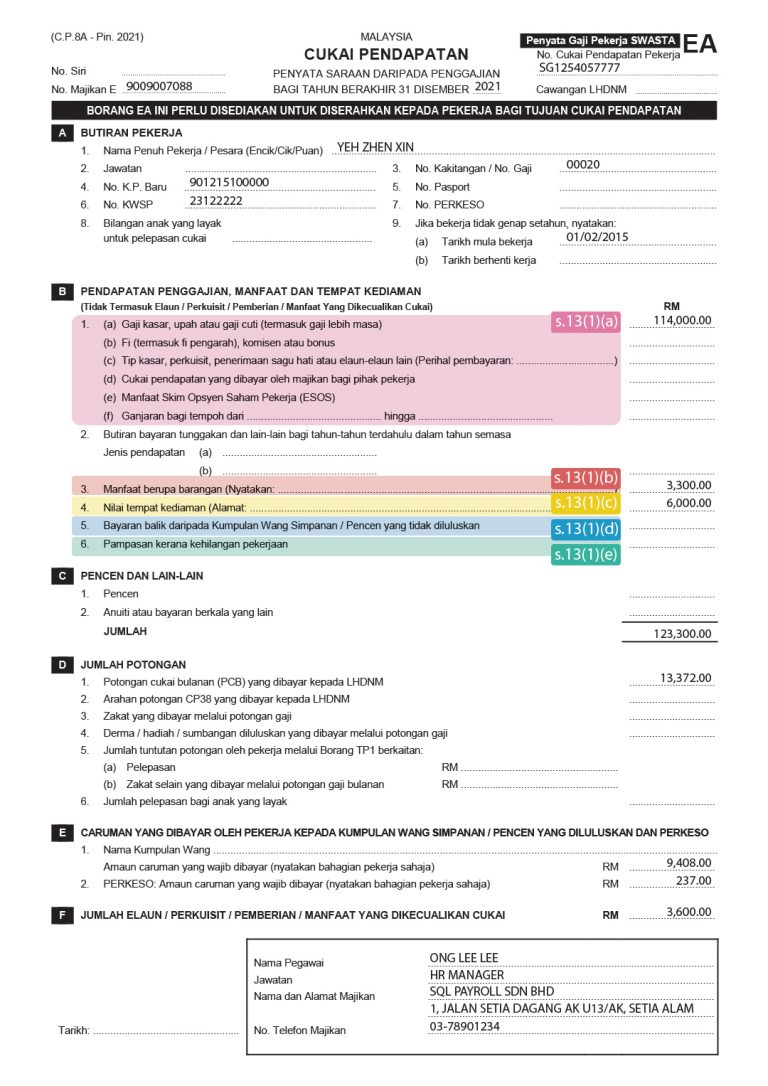

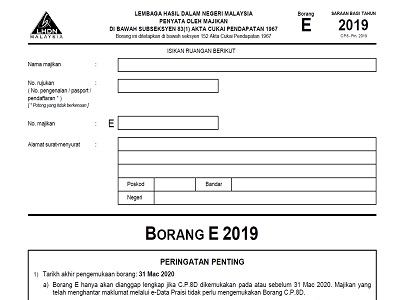

FORM TYPE CATEGORY DUE DATE FOR SUBMISSION. A reminder on the below deadline-Borang CP8A CP8C EA EC - to all employees on or before 28 February. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020.

SCHEDULE ON SUBMISSION OF RETURN FORMS. Grace period is given until 15 May 2021 for the e-Filing of Form BE Form e-BE for Year of. Upon filing Borangs 3 4 5 you will be able to extract your Borang 3 from the e-Kehakiman website.

April 30 for electronic filing ie. They are E Entertainments first group. Paying income tax due.

Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year. Many of the Income Tax related forms are quite difficult to find. Their name is an abbreviation of the word Everlasting.

30042022 15052022 for e-filing. March 31 for manual submission. Grace period is given until 15 May.

Membership lasts for one year from the date of the most recent qualifying donation. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. As of 2022 the deadline for filing Borang E in Malaysia is.

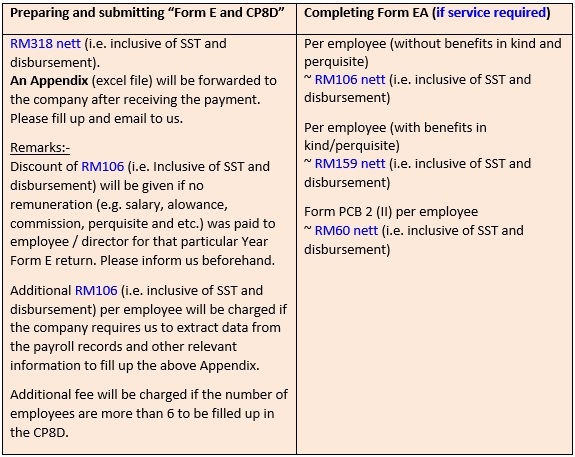

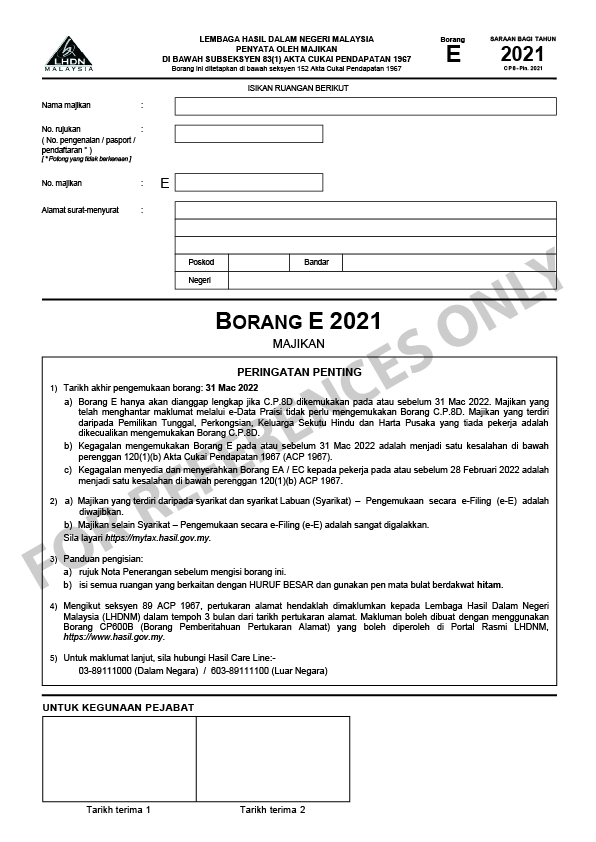

Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. Ini termasuklah borang E BE B M MT P TF. Having completed the forms and affirmed it you will need to file the Borangs.

Mulai 1 Mac 2022 kini pembayar cukai boleh mula mengemukakan Borang Nyata Tahun Saraan 2021 dan Tahun Taksiran 2021. Form BE Income tax return for individual who only received employment income Deadline. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

According to the Income. According to Section 83 1A Income Tax Act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration Form EA of that. 31032022 30042022 for e-filing 4.

All companies must file Borang E. Tarikh akhir hantar e filing borang b 2022. ELAST consists of Choi In Seungyeop Rano Baekgyeul Romin Won Hyuk Wonjun and Yejun.

Tarikh akhir hantar borang E 2022.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E Ea And Cp8d Employers Annual Tax Obligation Otosection

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Ea Form 2021 2020 And E Form Cp8d Guide And Download

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Understanding Lhdn Form Ea Form E And Form Cp8d

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Understanding Lhdn Form Ea Form E And Form Cp8d

E Filing 2020 Deadline Itr Filing Last Date Income Tax Return Filing Deadline For Fy 2020

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Tarikh Akhir Hantar Borang Cukai Efilling 2022 Tahun Taksiran 2021

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co